India’s Crude Shift: Oil Imports from US Soar Over 270% in Just Four Months

India has witnessed a dramatic surge in its crude oil imports from the United States during the first four months of the year, with volumes rising by over 270%. This spike not only highlights evolving dynamics in global energy trade but also reflects India’s strategic shift towards diversifying its energy sources and strengthening trade ties with the US. From geopolitical recalibration to energy security concerns, multiple factors are driving this remarkable change.

A Sharp Jump: Understanding the Numbers

Between January and April this year, India’s oil imports from the US increased by more than 270% compared to the same period last year. In absolute terms, this means that millions of additional barrels have been shipped to India from American ports, making the US one of the top five suppliers of crude to the country.

Previously, the US accounted for a relatively small fraction of India’s crude oil basket, with Middle Eastern nations like Iraq, Saudi Arabia, and the UAE dominating supplies. Russia also held a significant share in recent years. But now, the US is emerging as a major player, overtaking some traditional suppliers on a monthly basis.

Key Reasons Behind the Surge

1. Diversification for Energy Security

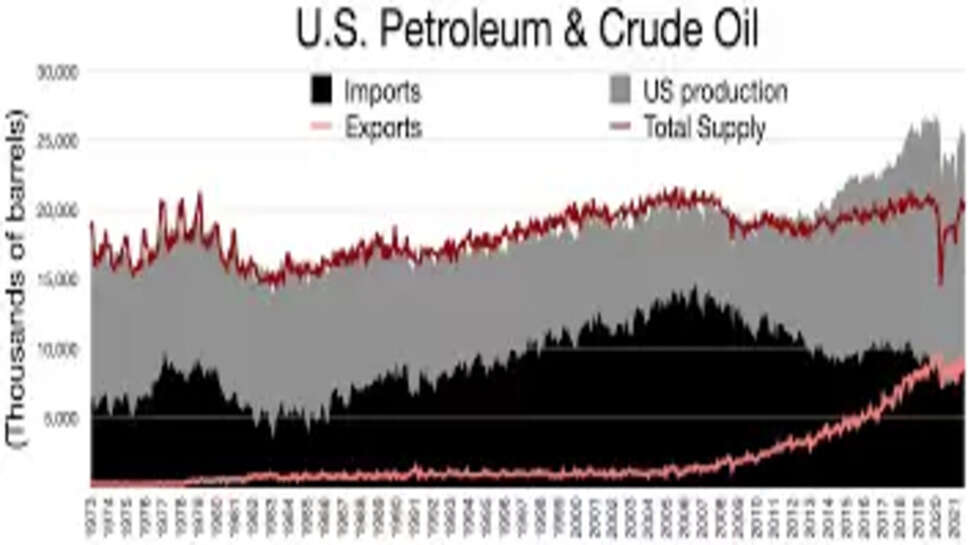

India’s energy needs are massive and growing. As one of the world’s largest importers of crude oil, the country is constantly looking to ensure energy security by sourcing oil from a variety of suppliers. Heavy reliance on a single region, such as the Middle East or Russia, poses risks in times of conflict, sanctions, or supply disruptions. The US, with its stable output and rising export capacity, offers an attractive alternative.

2. Geopolitical Strategy and Trade Diplomacy

Strengthening economic ties with the US has been a priority for Indian policymakers. The two nations are in the midst of trade negotiations, and boosting imports from America helps India address the long-standing trade imbalance, which has often been a point of contention. Importing more crude oil is one way India can reduce its trade surplus with the US while simultaneously securing a critical commodity.

3. Changing Price Dynamics

The global oil market is volatile, and pricing plays a crucial role in determining the origin of imports. In certain periods, American crude, particularly the light sweet variety, becomes cost-competitive compared to other sources. With flexible pricing models and availability on the spot market, US crude becomes a viable choice, especially when Indian refiners seek to optimize costs.

4. Improved Infrastructure and Logistics

India’s growing network of refineries, ports, and pipelines has made it easier to handle imports from distant suppliers like the US. Many of India’s modern refineries are capable of processing a wide range of crude grades, including American light sweet crude. This infrastructure readiness supports increased imports without the need for major upgrades or changes.

5. Refinery Optimization and Blending Needs

Refineries often require a blend of heavy and light crude oils for optimal operations. American oil, being lighter and sweeter, can complement heavier Middle Eastern or Russian grades. This balancing act allows refiners to produce more valuable outputs like gasoline and diesel, maximizing profitability.

April as a Turning Point

April stood out as a particularly significant month in this trend. Imports from the US surged, positioning America as India’s fourth-largest crude supplier that month. This climb, from a position far lower just a year ago, highlights how quickly the shift is happening. The volume of American oil arriving at Indian ports doubled compared to April of the previous year, indicating that this is not a temporary fluctuation but a strong upward trend.

This surge in imports also aligns with seasonal refinery activities. Some refineries ramp up operations during specific months when maintenance schedules allow full-capacity utilization. American crude, due to its properties, often fits into these operational windows more effectively.

Strategic Benefits for India

A. Reduced Geopolitical Risk

By sourcing oil from a broader pool of suppliers, India reduces its vulnerability to geopolitical shocks. For instance, tensions in the Middle East or sanctions on Russian oil can disrupt supply. US crude, coming from a relatively stable and regulated market, offers a reliable alternative.

B. Improved Bargaining Power

The presence of multiple suppliers in the market gives India stronger leverage in price negotiations. Traditional suppliers must now compete with the US for Indian market share, which can lead to better pricing and contractual terms for Indian refiners.

C. Support for Trade Balance

By importing more from the US, India helps narrow its trade surplus with America. This move not only supports ongoing trade negotiations but also strengthens the broader strategic partnership between the two countries.

D. Technological and Energy Collaboration

With growing oil imports, energy ties between India and the US could expand into other areas, such as natural gas, renewables, and energy storage. This shift opens the door to long-term collaboration in clean energy technology, infrastructure development, and energy security frameworks.

Challenges Ahead

Despite the positive outlook, several challenges could affect the momentum of US oil imports.

-

Cost and Freight: Shipping crude oil across the Atlantic is costlier and more time-consuming than sourcing it from the Middle East. These logistics must be justified by price advantages or strategic priorities.

-

Refinery Preferences: Not all Indian refineries are optimized for light sweet crude. Some are still better suited to processing heavier grades, which may limit the share of American oil in the overall import mix.

-

Market Volatility: Oil prices are influenced by global events, OPEC decisions, and currency fluctuations. If American crude becomes more expensive relative to other sources, refiners might reduce imports despite the strategic considerations.

-

Domestic Production and Alternatives: India is also working to increase its domestic oil production and boost the share of renewables in its energy mix. These efforts could reduce the overall dependence on imported oil over time.

As the year progresses, India’s oil import patterns will likely continue evolving. The current surge in US imports is part of a broader trend that reflects India’s maturity as a global energy player. It is no longer bound by legacy trade routes or traditional supplier relationships. Instead, it is making choices based on economics, energy security, and strategic interests.

Looking forward, this pivot could evolve into a deeper energy alliance between the two democracies. Beyond crude oil, there is scope for expanding cooperation into liquefied natural gas (LNG), clean hydrogen, solar energy, and energy storage technologies. If nurtured well, these ties could help both nations navigate the transition to a more secure, sustainable, and diversified energy future.

The more than 270% rise in India’s oil imports from the US in the first four months of the year is a significant development. It marks a turning point in India’s approach to energy sourcing—driven by diversification, diplomacy, and economics. While challenges remain, the trajectory signals a new era in India-US energy cooperation with implications far beyond barrels and trade balances.