Trump Pushes for Central Bank Power Shift, Says Fed Board Must Lead Without Powell

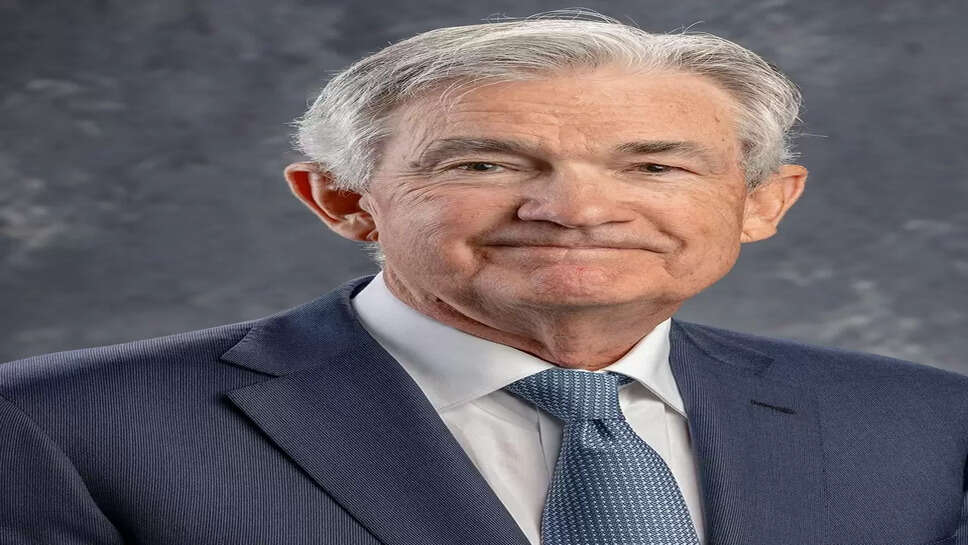

In a bold and controversial move that has reignited tensions over the independence of the U.S. central bank, former President Donald Trump has publicly called on the Federal Reserve Board of Governors to assume full control of the Federal Reserve System—effectively sidelining Chair Jerome Powell. The comments mark Trump’s most aggressive posture yet against Powell and signal his deepening frustration with the Fed’s monetary policy direction as the 2024 election cycle looms.

Speaking at a campaign rally in Florida and later elaborating in a televised interview, Trump accused Powell of “failing the American economy” and claimed the Fed’s current leadership has lost credibility. “It’s time for the board to step in and take control,” Trump said. “Powell has turned the Federal Reserve into a political weapon. We need real leadership, not someone who bends to the Biden agenda.”

Trump’s Ongoing Feud with Powell

This is not the first time Trump has publicly criticized Jerome Powell. During his presidency, Trump frequently lashed out at the Fed for what he perceived as overly cautious rate cuts and slow monetary easing, especially during trade tensions with China. He once referred to Powell as an “enemy” of the U.S. economy and even explored options to remove him from his post—though legal experts noted the Fed Chair cannot be fired without cause.

Powell, appointed by Trump himself in 2017 and later reappointed by President Biden, has sought to maintain the Fed’s independence, insisting that its policies are guided solely by economic data and not political pressure. However, Trump’s renewed attacks now suggest that, should he return to the Oval Office, he may attempt to reshape the Federal Reserve in a more aggressive and unconventional manner.

A Push for Structural Power Shift

Trump’s latest demand goes beyond verbal criticism—it proposes a structural shift in how the Fed operates. By calling on the Federal Reserve Board of Governors to “take full control,” Trump appears to be advocating for a collective leadership model that could override the Chair’s central role.

In theory, the Board of Governors already shares oversight responsibilities, but in practice, the Chair wields significant influence over monetary policy direction, communications, and the Federal Open Market Committee (FOMC). Trump's comments suggest a desire to decentralize that power or even reduce the Chair to a ceremonial role—a move that would be unprecedented in modern Fed history.

Trump did not provide specific legal or procedural details on how this power transfer would occur but stated that “the board has the authority if it chooses to act in the national interest.”

Legal and Institutional Implications

Experts in central banking and constitutional law are raising alarm bells over the implications of Trump’s proposal. The Federal Reserve was designed to be politically independent to shield it from the kinds of pressures that elected officials might exert for short-term gain. The notion of a sitting or former president pushing for an internal power realignment is deeply troubling to economists and financial analysts alike.

“There is no precedent for this kind of intervention,” said a former Fed legal counsel who spoke on condition of anonymity. “The Chair is appointed by the President and confirmed by the Senate. Trying to usurp that role through internal board rebellion would damage the Fed’s credibility and its very ability to function independently.”

If Trump or his allies attempt to implement such a change in a future administration, it could trigger a constitutional standoff, especially if existing laws protecting the Fed Chair’s role are challenged or reinterpreted through executive authority.

Political Context and 2024 Ramifications

Trump’s remarks come amid a broader strategy to blame economic hardships—such as inflation, rising interest rates, and mortgage affordability—on the Biden administration and its appointees. With Jerome Powell often perceived by conservatives as emblematic of the “Washington establishment,” targeting him helps Trump frame the economy as being mishandled by unelected bureaucrats.

Analysts suggest that Trump’s focus on the Fed could resonate with populist voters, many of whom distrust large financial institutions and feel left behind by monetary policy decisions that favor Wall Street over Main Street.

“Trump is tapping into a long-standing American skepticism of central bankers,” said political strategist Laura Mendoza. “By turning Powell into a villain, he gives his base someone concrete to blame for economic anxiety.”

At the same time, his rhetoric could alienate centrist voters and moderates in the business community, many of whom view central bank stability as essential for investor confidence and macroeconomic health.

Market Reactions and Financial Concerns

Financial markets reacted nervously to Trump’s comments. On the day of his statement, bond yields saw a brief uptick while the dollar dipped slightly—signaling concerns about future Fed independence and predictability.

Wall Street analysts expressed unease over the potential politicization of monetary policy. “Markets don’t like uncertainty,” said one investment strategist. “Any suggestion that the Fed could become a tool of the executive branch undercuts the trust that global investors place in the U.S. economy.”

International observers, too, are watching closely. Central banks around the world often model themselves on the Federal Reserve’s standards of independence. Any sign of political encroachment could send ripple effects through global monetary policy circles.

The Fed’s Response

As of now, the Federal Reserve has not issued an official response to Trump’s statements. Jerome Powell, known for his measured and diplomatic approach, is unlikely to engage directly with political commentary. However, in past speeches, he has reaffirmed the Fed’s commitment to data-driven, apolitical policy decisions—implicitly pushing back against critics without naming names.

Privately, however, Fed officials are said to be concerned about growing political hostility and the implications of a possible second Trump administration.

What Comes Next?

Trump’s call for a shift in Fed leadership control marks another chapter in the ongoing debate about how independent central banks should be—and who they should be accountable to. While the statement may be rhetorical in the short term, it raises important questions for the future of U.S. monetary governance.

If Trump wins the 2024 election, he could influence the Fed not only through public pressure but also through appointments. Several Fed Board positions are expected to open up in the next few years, offering any president an opportunity to shape the institution’s ideological makeup.

Whether Trump’s comments translate into action remains to be seen. But one thing is clear: the battle for the soul of the Federal Reserve may become a defining issue in the coming political cycle—one that pits populist governance against institutional independence.

Final Thoughts

Trump’s assertion that the Federal Reserve Board should seize control from Chair Jerome Powell is more than a campaign soundbite. It’s a reflection of how deeply political institutions—once considered technocratic and neutral—have become battlegrounds for ideological control. For now, Powell remains in charge, but the road ahead for America’s central bank looks increasingly fraught with political peril.